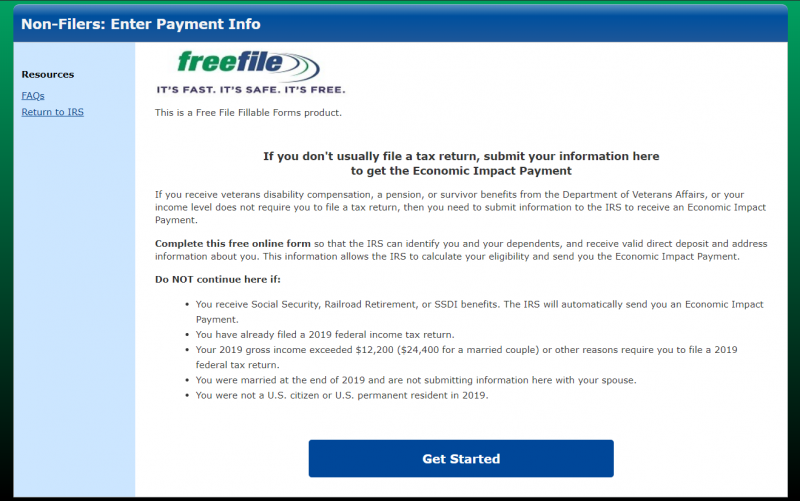

The www.irs.gov/freefile fillable forms Forms program is a no-cost option for taxpayers who prefer to prepare and file their federal tax returns electronically without relying on commercial tax software. This option is particularly helpful for those comfortable with filling out tax forms manually.

IRS Fillable Forms Overview

IRS Free File Fillable Forms are electronic versions of the federal tax forms that anyone can use, regardless of income, to file their taxes online. Unlike the guided interfaces offered by tax preparation software, these forms require taxpayers to have a solid understanding of tax rules.

- Taxpayers with simple returns.

- Those who are familiar with tax forms and IRS instructions.

- Individuals looking for a free filing option without income restrictions.

Benefits

- Cost-Free Option: Perfect for those who don’t want to pay for tax preparation services or software.

- Speedy Refunds: E-filing combined with direct deposit can expedite your refund process.

- Environmental Impact: Filing electronically reduces paper usage.

- Customizable: This lets you complete only the forms relevant to your tax situation.

Key Features of Free Fillable Forms

If you prefer a guided process or have a complex tax situation, consider using IRS Free File software options or consulting a tax professional.

- No Income Limits: Unlike other free file options that cap eligibility at $73,000 in income, Fillable Forms are available to everyone.

- E-Filing Capability: Submit your federal tax return electronically and receive confirmation from the IRS.

- Access to Common Tax Forms: Includes a variety of forms like the 1040, 1040-SR, and schedules for credits and deductions.

- Basic Calculations: Some fields perform automatic calculations to reduce errors.

Use File Fillable Forms

- Access the Forms: Visit the www.irs.gov/freefile fillable forms and create an account.

- Gather Necessary Documents: Before you start, have these on hand:

- W-2s, 1099s, and other income statements.

- Records of deductible expenses and credits.

- Prior year’s Adjusted Gross Income (AGI) or IRS Identity Protection PIN for authentication.

- Choose the tax forms and schedules that apply to your situation and enter the information.

- Use the system’s basic calculation functions to verify totals.

- Double-check entries to ensure accuracy.

Once completed, submit your return electronically. You’ll receive a confirmation email once the IRS accepts your submission.