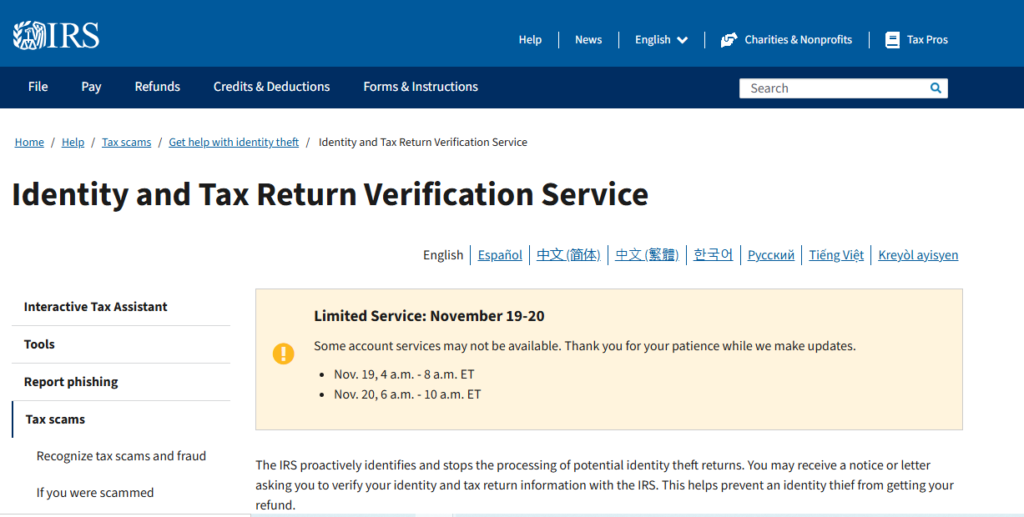

The IRS has implemented several measures to combat identity theft and fraudulent tax filings. One of these is the IRS Return Verification tool, available at irs.gov/verifyreturn. This tool allows taxpayers to confirm the legitimacy of their electronically filed tax returns through irs.gov/verifyreturn if flagged for potential fraud.

IRS Return Verification

When the IRS suspects unusual activity with your tax return, they may send a 5071C, 5747C, or related notice, requesting that you verify your identity. The Verify Your Return page provides a secure platform for completing this verification quickly and efficiently.

Use IRS.gov/VerifyReturn

If you encounter issues while verifying your return or cannot complete the process online, contact the IRS directly at the number listed on your notice.

- Before starting, gather the following:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- The tax return referenced in the IRS notice (Form 1040 or similar).

- A valid email address.

- Your prior year’s tax return for additional identity confirmation.

- Navigate to irs.gov/verifyreturn and follow the prompts to begin the process.

- You’ll answer security questions and provide information from the flagged tax return.

- Once your identity is confirmed, the IRS will continue processing your tax return.

By promptly responding and verifying your return, you help ensure the security of your financial information and minimize delays in receiving your refund.

Benefits of Using VerifyReturn

Verifying your tax return through IRS.gov/verifyreturn ensures both the security of your data and the integrity of the tax filing process.

- Enhanced Security: Protects your personal information and prevents fraudulent refunds.

- Fast Processing: Resolves identity issues quickly to avoid delays in your tax refund.

- Convenient Access: Available online 24/7, saving you the hassle of phone calls or in-person visits.

The IRS’s robust tools make it easier for taxpayers to resolve issues online, contributing to a smoother and more secure tax experience.