Managing your finances is easier than ever with fidelity.com/movemoney feature. Whether you’re transferring funds, paying bills, or setting up automatic deposits, this tool provides a fast, secure, and efficient way to stay in control of your money.

Benefits of Move Money

Fidelity’s Move Money is an online and mobile platform that lets you transfer money between accounts, and send funds to external institutions.

- Move money between your Fidelity accounts or to external bank accounts with just a few clicks.

- Set up direct deposit for paychecks, government benefits, or other income directly into your Fidelity account.

- Set up recurring transfers or payments to make saving, investing, or paying bills effortlessly. With automation, you can focus on your goals.

- Fidelity uses cutting-edge encryption and multi-factor authentication to protect your transactions.

It’s designed for users who want flexibility and speed in managing their cash flow.

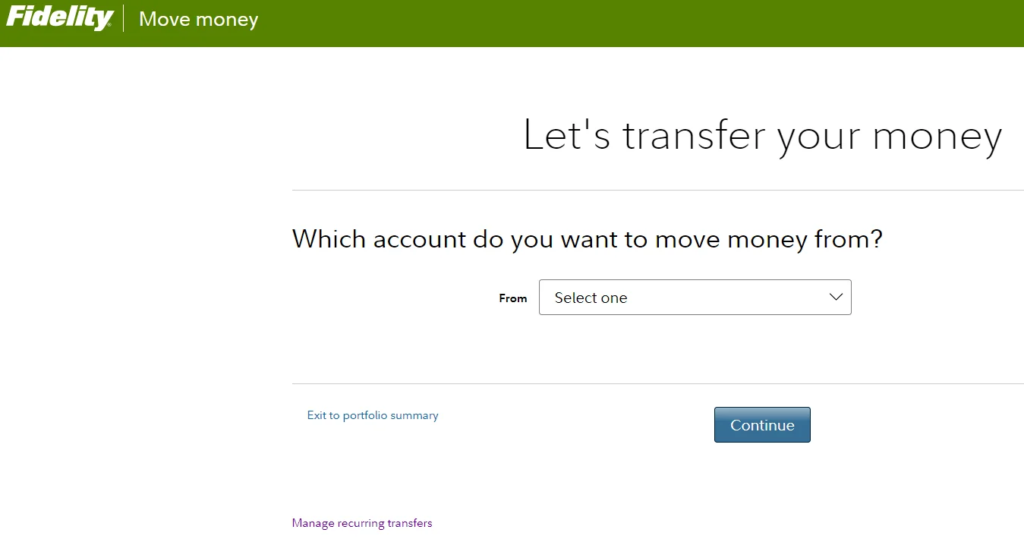

How to access Fidelity Move Money option?

Allocate funds directly to your brokerage or retirement accounts to stay on track with your financial goals and focus on your goals while Fidelity handles the logistics.

- Log In to Your Fidelity Account: Visit fidelity.com or use the Fidelity mobile app.

- Navigate to “Move Money”: Locate the Move Money tab in your account dashboard.

- Choose Your Transaction Type:

- Transfer Funds: Move money between accounts or to an external institution.

- Deposit Money: Set up direct deposits or use the mobile check deposit feature.

- Pay Bills: Schedule and manage bill payments.

- Follow the Prompts: Enter the required details, confirm your transaction, and you’re done.

Fidelity uses cutting-edge encryption and multi-factor authentication to protect your transactions. Rest assured that your money is safe at every step.

Importance

With Fidelity’s Move Money, you get the perfect blend of convenience, security, and integration. It’s designed to save you time and reduce the hassle of managing your finances.

- Investors: Easily fund your brokerage accounts to seize new opportunities.

- Savers: Automate contributions to savings accounts or IRAs.

- Everyday Users: Manage day-to-day finances, pay bills, and transfer funds securely.