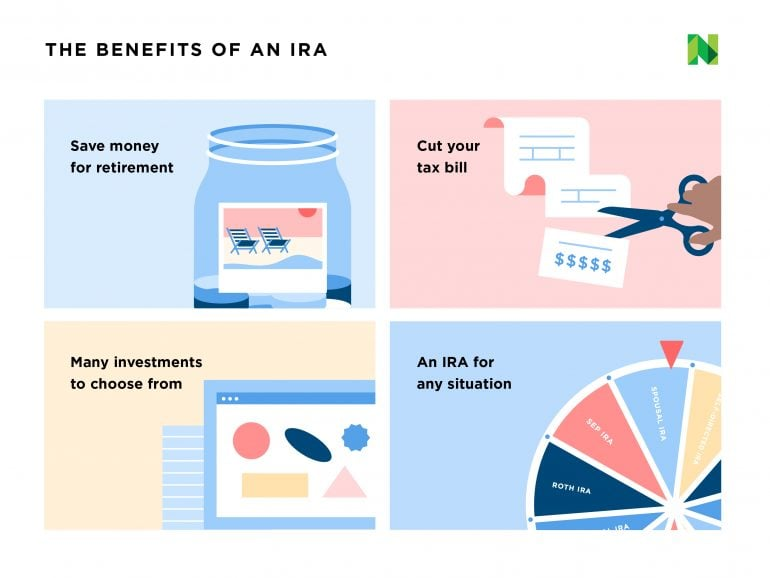

IRA Tax is a powerful tool for building a secure financial future, but understanding their tax implications is key to maximizing their benefits. Whether you’re contributing to a traditional IRA, a Roth IRA, or withdrawing funds during retirement, taxes play a significant role.

IRA Contributions and Taxes

- Deductible contributions lower your taxable income, potentially reducing your overall tax liability.

- The ability to deduct contributions phases out at certain income levels if you or your spouse are covered by a workplace plan. For 2024, phase-out ranges are:

- Single filers: $68,000 to $78,000.

- Married filing jointly: $109,000 to $129,000.

- Contributions are made with post-tax income, so they don’t reduce your taxable income. However, they provide tax-free growth and withdrawals.

Withdrawals and Taxes

Convert Traditional IRA funds to a Roth IRA during years of lower income to potentially reduce future tax liabilities. Contribute the maximum allowed each year to enjoy tax-deferred or tax-free growth.

Traditional IRA Withdrawals

- Before Age 59½: Withdrawals are generally subject to a 10% penalty plus ordinary income tax. Exceptions include first-time home purchases, medical expenses, or higher education costs.

- After Age 59½: Withdrawals are taxed as ordinary income but are penalty-free.

- RMDs: Starting at age 73, you must take RMDs, which are fully taxable as ordinary income.

Roth IRA Withdrawals

- Qualified Withdrawals: Tax-free if the account has been open for at least five years and the account holder is over 59½ (or for certain exceptions like first-time home purchases).

- Non-Qualified Withdrawals: Contributions can be withdrawn tax-free at any time, but earnings may be taxed and penalized.

Common Mistakes to Avoid

IRAs are versatile and tax-advantaged, but understanding their tax rules is essential to fully realize their benefits.

- Missing RMDs: Failing to take your RMDs results in a 25% penalty on the amount not withdrawn.

- Excess Contributions: Overcontributing to your IRA incurs a 6% penalty each year until corrected.

- Ignoring Taxable Events: Roth conversions and non-qualified withdrawals can trigger unexpected tax liabilities.

By staying informed, planning withdrawals strategically, and avoiding common mistakes, you can optimize your retirement savings while minimizing tax burdens.