Fidelity Investments is one of the largest and most well-established financial services firms in the world, offering a wide array of services to individuals, institutions, and financial advisors.

Whether you are planning for retirement, managing your investments, or seeking financial advice, Fidelity provides tools, resources, and expertise to help you meet your financial goals.

How to fidelity investment work?

The firm’s offerings span investment management, brokerage services, retirement planning, and wealth management, with a focus on helping clients navigate complex financial markets and plan for their futures.

- Investment Management: Fidelity provides a broad array of mutual funds, exchange-traded funds (ETFs), and other investment products designed to help investors build diversified portfolios.

- Brokerage Services: Fidelity’s brokerage division offers self-directed investing services, enabling customers to trade stocks, bonds, options, and ETFs with competitive fees and commissions.

- Wealth Management and Financial Planning: For those seeking personalized financial advice, Fidelity offers wealth management services, including financial planning and tax management.

- Institutional Services: In addition to serving individual investors, Fidelity provides institutional services to pension funds, endowments, and other large organizations.

- Retirement Services: Fidelity is one of the leading providers of retirement services in the United States, managing billions of dollars in assets across individual retirement accounts (IRAs), 401(k) plans, and other retirement products.

With its commitment to technology, research, and customer service, Fidelity remains a trusted partner for investors looking to achieve their financial goals.

Fidelity Retirement & Investment Plans

These plans are designed to help individuals save for retirement, providing tax advantages and long-term growth potential.

- 401(k) Plan (Employer-Sponsored): A 401(k) is a retirement plan offered by employers that allows employees to save for retirement on a tax-deferred basis. Contributions are typically made through automatic payroll deductions.

- IRA (Individual Retirement Account): An IRA is a personal retirement account that provides tax advantages for retirement savings. There are two main types: traditional and Roth IRAs.

- Education Investment Plans: These plans are aimed at helping families save for educational expenses, such as tuition, books, and other costs related to schooling.

- General Investment Plans: For those looking to build wealth outside of retirement or education savings, these plans focus on creating a diversified investment portfolio.

- Custom Investment Plans: For more advanced investors, custom investment plans can be created to suit specific financial goals, risk tolerance, and time horizons.

When choosing an investment plan, it’s important to consider factors like your financial goals, risk tolerance, time horizon, and liquidity needs.

Register for a Fidelity Account

To register for a Fidelity account, you can follow these steps. Note that the process may vary slightly based on the type of account you’re opening (individual brokerage, retirement account, etc.).

- Open your web browser and go to Fidelity’s official website.

- On the homepage, you will see an option to “Open an Account” or “Get Started.”

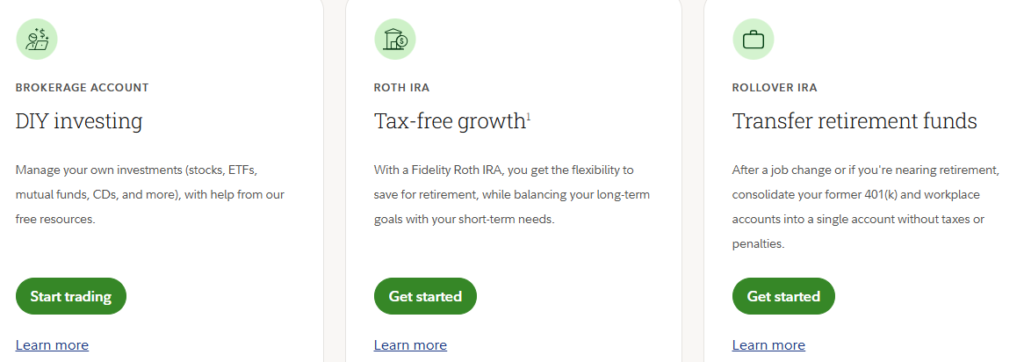

- Select the type of account you want to open (e.g., individual brokerage account, retirement account (IRA), joint account, etc.).

- Click on the appropriate option to begin the registration process.

- You may be asked if you are a new customer or an existing customer. Choose New Customer if you don’t have an account.

- Provide Your Personal Information:

- Full Name: Enter your first and last name.

- Social Security Number (SSN): This is required for identity verification.

- Date of Birth: Your birthdate to confirm you’re of legal age (usually 18+).

- Address: Provide your current residential address (must be a U.S. address).

- Email Address: You’ll need a valid email address for communication.

- Phone Number: A contact number where Fidelity can reach you.

- Choose a username that you will use to log into your Fidelity account.

- Review and agree to Fidelity’s terms and conditions, privacy policy, and other legal agreements.

- After reviewing all your information and confirming its accuracy, click the Submit button.

- Fidelity may verify your information and send you an email confirmation once your account is approved.

Once your account is set up, you can begin trading, investing, or using the tools and resources Fidelity offers for managing your finances.