The Vanguard Target Retirement Income Fund is designed for retirees who are near retirement and want to invest in a diversified portfolio that balances income generation with moderate growth.

As one of the offerings in Vanguard’s Target Retirement series, this fund provides a simple solution for those who want a hands-off approach to managing their retirement savings.

Key Components of Vanguard Retirement Fund

The Vanguard Target Retirement Income Fund is designed to meet the needs of retirees or those near retirement, with a focus on providing steady income and a conservative approach to investing. Here are the key features of this fund:

- Automatic Adjustment of Asset Allocation: The fund automatically adjusts its asset allocation as you near or enter retirement. The allocation becomes more conservative over time, shifting from a higher percentage of stocks to a greater focus on bonds and income-producing investments.

- Underlying Vanguard Funds: The Vanguard Target Retirement Income Fund is composed of a variety of underlying Vanguard mutual funds, including:

- Vanguard Total Stock Market Index Fund

- Vanguard Total International Stock Index Fund

- Vanguard Total Bond Market Index Fund

- Vanguard Inflation-Protected Securities Fund

- Cost Efficiency: The Vanguard Target Retirement Income Fund is known for its low expense ratio of 0.12%. This is significantly lower than the industry average for target-date funds, ensuring that more of your money stays invested and works for you.

With Vanguard’s reputation for low-cost, high-quality fund management, VTXIX provides a reliable, long-term solution for retirees who want to reduce the complexities of retirement planning.

How to access the Vanguard Retirement Plan?

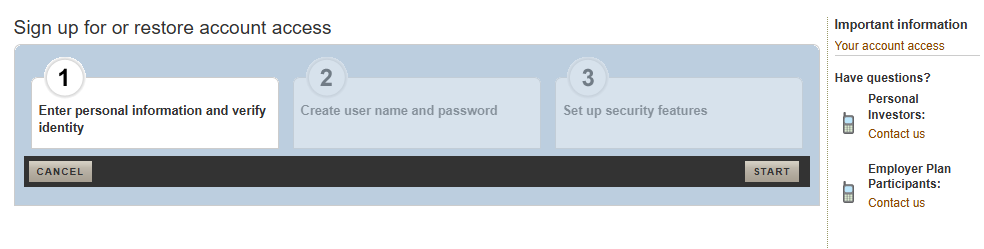

To access your Vanguard retirement plan, you’ll need to log in to your Vanguard account online. Here’s how to do it:

- Go to the Vanguard Website: Visit the official Vanguard website at www.vanguard.com.

- Click “Log In”: In the top right corner of the page, you will find the “Log In” button. Click it to proceed.

- Enter Your Login Details: You’ll be prompted to enter your username and password. These are the credentials you set up when you opened your Vanguard retirement account.

- Two-Factor Authentication: If you have enabled two-factor authentication, Vanguard will send a code to your phone or email. Enter that code to complete the login process.

Accessing your Vanguard retirement plan is a straightforward process that can be done through Vanguard’s website, mobile app, or by contacting customer support.

Important Considerations Vanguard Target Funds

While the Vanguard Target Retirement Income Fund is a strong option for retirees or those nearing retirement, it’s important to consider several factors before deciding whether it aligns with your financial goals. Below are the key considerations to keep in mind when investing in this fund:

- Lower Risk, Lower Growth: This fund is designed for conservative investors, focusing on stability and income generation rather than aggressive growth. If you’re seeking higher returns or more growth potential, this fund may not be the best fit.

- Automatic Glide Path: The fund’s asset allocation shifts gradually over time, becoming more conservative as you approach retirement. While this is beneficial for many investors, it’s important to assess whether the fund’s decreasing stock exposure aligns with your long-term financial goals.

- Inflation Impact on Bonds: Inflation can erode the purchasing power of fixed-income investments. While the fund holds inflation-protected securities (TIPS), it may not fully offset the effects of rising inflation on the value of the income generated by the fund.

- Decumulation Phase: For retirees, the Vanguard Target Retirement Income Fund is suitable for the “decumulation” phase, where the focus shifts from accumulating wealth to drawing down savings.

- No Additional Fees or Sales Loads: Vanguard’s policy of no sales loads or additional management fees makes the fund even more attractive for cost-conscious investors. This can lead to higher net returns compared to funds with higher expense ratios.

Advantages of Vanguard Target Retirement

The Vanguard Target Retirement Income Fund is ideal for individuals who are already retired or are close to retirement and want a more conservative investment strategy that balances income generation and moderate growth.

- Low Expense Ratio: With an expense ratio of just 0.12%, it’s one of the most cost-effective options in the target-date fund category.

- Diversification: The fund offers broad diversification through a mix of U.S. and international stocks and bonds, which helps reduce risk.

- Automatic Asset Allocation: The fund adjusts its asset allocation over time, reducing exposure to higher-risk assets as you near or enter retirement.

- Consistent Income: It provides regular income through its bond-heavy allocation, making it suitable for retirees who need to preserve capital and generate income.

- Easy to Manage: As a “set it and forget it” type of investment, this fund is ideal for investors who don’t want to manage their portfolios actively.

Its low cost, diversification, and automatic asset allocation make it an appealing option for those looking for a hands-off, income-oriented investment strategy.