A Target Date Funds is a mutual or exchange-traded fund (ETF) designed to provide a diversified investment portfolio tailored to a target retirement year. The “target date” typically corresponds to the year an investor expects to retire.

The key feature of a TDF is its automatic asset allocation adjustment over time. As the target date approaches, the fund gradually shifts from a growth-focused portfolio (with a higher percentage of stocks) to a more conservative portfolio (with a higher percentage of bonds and cash).

How do Target Date Funds work?

Target Date Funds follow a preset glide path, which is the strategy that determines how the asset allocation evolves. Early in an investor’s career, a TDF will have a heavier allocation in equities (stocks), as the investor has a longer time horizon to ride out market volatility.

This gradual transition helps minimize the risk of significant losses as the investor nears retirement while still allowing for some growth potential. Once the target date is reached, the fund may become more conservative, or it may continue to adjust the allocation to a stable retirement income strategy.

Key Features of Target Date Funds

It offers several important features that make it an attractive investment option, especially for those planning for retirement. Here are the key features that distinguish them:

- Set Target Date: The defining feature of a Target Date Fund is its target date, which is usually based on the year an investor expects to retire (e.g., 2045 or 2050).

- Automatic Asset Allocation Adjustment: One of the most attractive features of Target Date Funds is their ability to automatically adjust the mix of assets within the fund.

- Diversification: Target Date Funds are inherently diversified, as they invest across a variety of asset classes such as domestic and international equities, bonds, and sometimes other assets.

- Professional Management: These funds are managed by professional portfolio managers who are responsible for deciding how to allocate and adjust the portfolio’s investments.

- Low Maintenance: Target Date Funds are designed to be low maintenance, making them ideal for investors who prefer a “set it and forget it” approach.

Target Date Funds are an excellent option for retirement planning, offering a combination of convenience, diversification, and professional management.

Consider before Investing in a Target Date Fund

If you’re looking for an easy way to save for retirement without having to constantly monitor your investments could be the right fit.

- Fees: While Target Date Funds offer convenience, investors should pay attention to the fees associated with the fund. The expense ratio of the fund can impact the overall returns over time. Some funds charge higher fees due to active management, so it’s important to compare the fees of different TDFs before investing.

- Glide Path: Not all Target Date Funds follow the same glide path. Some funds may reduce their stock allocation more aggressively as the target date approaches, while others may remain slightly more aggressive even in retirement. It’s essential to review the fund’s glide path to ensure it aligns with your risk tolerance and retirement goals.

- Asset Allocation: Even though TDFs are diversified, investors should still evaluate the fund’s specific asset allocation. Some funds may have a higher exposure to equities or bonds than you are comfortable with, so it’s important to understand how the fund’s allocation aligns with your financial objectives.

However, it’s crucial to assess the fund’s fees, glide path, and asset allocation to ensure it fits with your long-term financial goals and risk tolerance.

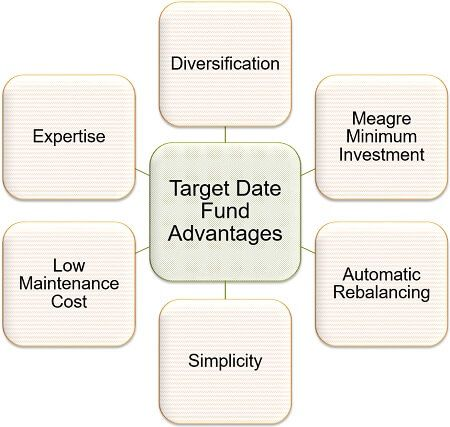

Advantages of Target Date Funds

This diversification helps manage risk and aims to provide stable returns over time, balancing the need for growth in the early years with a focus on capital preservation as retirement nears.

- Simplicity and Convenience: Designed to be “set-it-and-forget-it” investments, making them ideal for investors who prefer a hands-off approach. With automatic rebalancing and adjustments to the asset allocation, investors don’t have to worry about making regular changes to their portfolio as they would in a self-managed account.

- Diversification: TDFs typically invest in a mix of asset classes, such as domestic and international stocks, bonds, and sometimes alternative assets like real estate or commodities. This diversification helps spread risk across various sectors of the market.

- Professional Management: Target Date Funds are managed by investment professionals who handle the day-to-day decision-making, including the rebalancing and adjustments to the portfolio’s asset allocation. This means that investors do not have to be experts in investing.

However, it is essential to review the fund’s fees, glide path, and overall asset allocation to ensure it matches your long-term financial needs.

Are Target Date funds expensive?

TDF expenses usually depend on the particular TDF and the fund provider. The expense ratio of the fund is competitive with various other mutual funds. TDFs utilizing strategies of the passive index come at a lower expense ratio compared to the ones having strategies of active management.

Investors need to conduct deep research and compare the expense ratio, performance of the fund, and history of different TDFs before settling for one.