Cash App Taxes is a free tax filing service integrated into the Cash App platform. It allows users to file their federal and state tax returns without having to pay any filing fees, making it a significant advantage for those looking to save money during tax season.

Unlike other tax filing software, Cash App Taxes aims to provide an easy, user-friendly experience for individuals and families, with features like automatic import of tax documents and the ability to file simple to moderately complex returns.

Key Features of Cash App

With its user-friendly interface, integration with your Cash App account, and no-cost filing for federal and state returns, it’s an attractive choice for many taxpayers, especially those with tax situations.

- Free Filing: No fees for federal or state tax filing.

- Import Your Cash App Transactions: You can import transaction data directly from your Cash App account to streamline the process.

- Simple Tax Filing: File straightforward returns with ease.

- Support for Multiple Tax Forms: Cash App Taxes supports a range of common tax forms, including W-2s, 1099s, and more.

Nonetheless, Cash App Taxes is a solid choice for most individual filers looking to save money and file with ease. This application uses secure encryption methods to protect your personal and financial data during the filing process.

How to use Cash App Taxes?

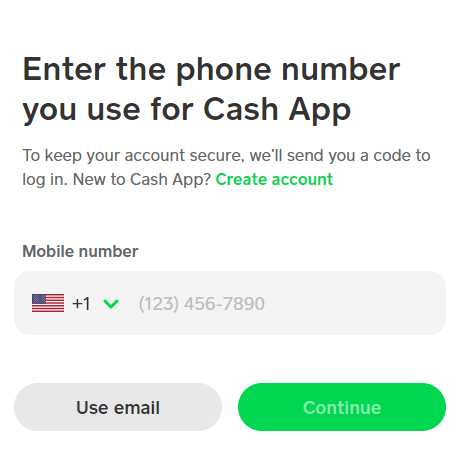

To use Cash App Taxes, you first need to have a Cash App account. If you don’t already have one, you can easily create an account via the Cash App mobile app or website. Once your Cash App account is set up, follow the simple instructions:

- Download and open the Cash App on your mobile device or visit the Cash App website.

- In the app, navigate to the “Tax Filing” section. This can be found under the “Banking” tab or directly in your account settings.

- Cash App Taxes will guide you through the process step by step. The questions are straightforward, covering basic personal information, income, deductions, and credits.

- After completing your tax return, review it carefully for accuracy. Once satisfied, submit your federal and state returns directly from the Cash App platform.

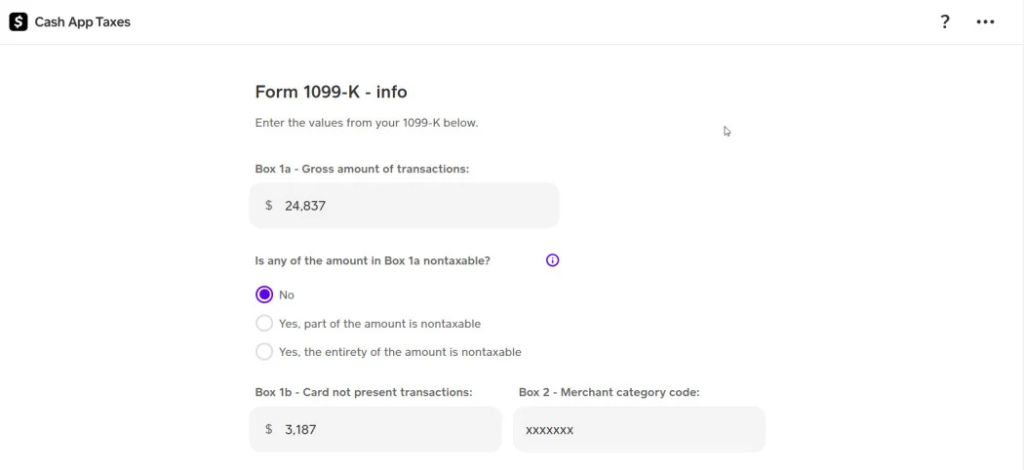

Cash App Taxes allows you to import your tax forms directly from your Cash App account, making the filing process faster and easier. Along with this procedure, the user needs to offer the common tax reforms and scenarios such as:

- W-2: For individuals employed by a company.

- 1099: For freelancers, independent contractors, or those with non-employee compensation.

- 1040: The standard form for individual income tax returns.

- State Returns: Cash App Taxes support filing for multiple states.

While Cash App Taxes is perfect for most individual taxpayers, it may not be suitable for those with very complex tax situations (e.g., if you need to file business taxes or have extensive investments).

How to file taxes online with Cash App?

Cash App Taxes offers a no-cost option for filing both federal and state taxes. Many other tax platforms charge fees for filing state taxes or extra services, but Cash App Taxes allows you to file state taxes at no additional charge.

This makes it an excellent option for individuals who want to save money, especially when dealing with simple returns that do not require extra schedules or forms.

- Cash App automatically imports your W-2 or 1099 forms from your Cash App account.

- You’ll fill out easy questions regarding income, deductions, and dependents.

- Cash App Taxes will automatically calculate your tax liabilities and refunds.

- Once your tax return is ready, you can submit it directly from the app.

While Cash App Taxes is an attractive option, it’s important to consider how it stacks up against other popular tax filing platforms.

Benefits of Using CashApp Taxes

There are several benefits to choosing Cash App Taxes for your tax filing needs. Here’s why it’s worth considering:

- Other tax filing services often charge fees for filing state returns, additional forms, or certain features, but Cash App Taxes offers everything for free.

- The integration makes the process seamless, and you can import the transactions from your Cash App account directly, saving you time and minimizing the chance of errors.

- Provides an intuitive, easy-to-navigate platform, and if you’re not familiar with tax filing, the interface is simple and easy to follow.

- Cash App Taxes offers an accuracy guarantee, meaning they promise that your tax return will be filed correctly and any errors made by the system.

While it doesn’t offer live support, its integration with the Cash App and simple interface makes it an ideal choice for most individuals with straightforward tax situations.