Fidelity Life Insurance Company was founded in 1896, making it one of the oldest life insurance providers in the United States. Over the years, it has established itself as a reliable company offering life insurance coverage to millions of policyholders.

Fidelity Life is headquartered in Chicago, Illinois, and has earned a strong reputation for providing flexible and affordable life insurance options.

Types of Fidelity Life Insurance

Fidelity Life provides several life insurance options, each designed to address different financial needs and goals. The main types of life insurance offered by Fidelity Life include:

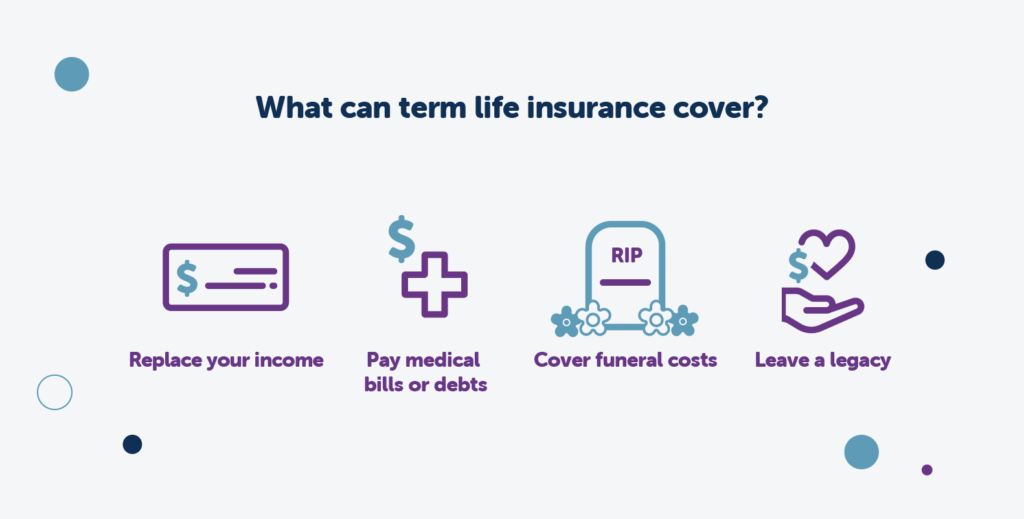

- Term Life Insurance: This policy offers coverage for a specific period, typically 10, 20, or 30 years. It is a cost-effective solution for those looking for affordable premiums and coverage for a fixed duration.

- Permanent Life Insurance: This includes both Whole Life and Universal Life insurance policies. Permanent life insurance provides lifelong coverage and the potential for accumulating cash value over time.

- Final Expense Insurance: Specifically designed to cover funeral costs and other end-of-life expenses, this policy is ideal for individuals who want to ease the financial burden on their families.

Whether you’re looking for a simple term policy or a more comprehensive permanent life policy, Fidelity Life has options that can meet your needs.

Apply for Insurance with Fidelity Life

The application process for Fidelity Life Insurance is straightforward and can be done online or over the phone. The steps generally include:

- Decide on the type of life insurance that best suits your needs—whether it’s term life, permanent life, or final expense coverage.

- Provide personal information, including health history, lifestyle habits, and financial details.

- After completing the application, review the terms and conditions before submitting.

- Depending on the policy type, you may undergo a medical exam or provide additional documentation.

- Once your application is approved, you will receive your policy, and coverage will begin.

With a reputation for financial stability, a straightforward application process, and good customer service, Fidelity Life stands out in the crowded life insurance market.

Customer Service and Support

Fidelity Life takes pride in its customer service, offering multiple channels for support. Customers can reach the company through their website, phone, or by visiting one of the company’s local offices.

The company’s agents are knowledgeable and ready to assist policyholders with any inquiries, whether it’s about policy details, claims, or general questions.

Fidelity Life also provides an online portal where policyholders can manage their accounts, pay premiums, and track their claims easily.

Enroll for Fidelity Life Plans

By following these steps, you can successfully enroll in a Fidelity Life Insurance policy. If you need assistance, their customer support and agents are always available to help guide you through the process.

- Visit the official website of Fidelity Life Insurance at www.fidelitylife.com.

- Fidelity Life offers a range of policies, and you should choose the one that fits your needs if you need coverage for a specific period (e.g., 10, 20, or 30 years).

- Fill Out the Online Application: Once you’ve selected your policy, you can begin the application process. Fidelity Life provides an online form where you’ll need to provide personal details.

- If you have questions about the process or need help selecting the right policy, Fidelity Life offers the option to speak with an agent.

- After reviewing all of your information and confirming the details of the policy, submit your application.

Benefits of Fidelity Insurance

Fidelity Life Insurance offers a variety of benefits to policyholders, making it an attractive option for many. Some of the key benefits include:

- Flexibility: Fidelity Life provides flexible policy options, allowing customers to adjust their coverage as their needs change over time.

- Affordable Premiums: The company is known for offering competitive rates that fit various budgets, making life insurance accessible to more people.

- Quick Application Process: Fidelity Life offers a streamlined application process, with some policies offering no medical exam for applicants.

- Strong Financial Stability: Fidelity Life has maintained a solid financial track record, giving policyholders peace of mind that the company can meet its obligations.

While Fidelity Life offers competitive products, it’s important to compare it with other life insurance providers to make an informed decision.