TurboTax 2024 has long been recognized for its ease of use, accuracy, and ability to walk users through even the most complex tax situations. With each new tax year, TurboTax continues to refine its product and introduce new features, making the process even easier and more intuitive.

Key Features and Updates

TurboTax 2024 brings a combination of fresh features, tax law updates, and enhanced user experience improvements. Review the updated changes in TurboTax software:

- Updated Tax Law Changes: TurboTax has incorporated updates based on changes to both federal and state tax regulations, ensuring that you’re filing your return in full compliance.

- TurboTax Live Enhanced Features: It provides users with access to real tax experts via chat, phone, or video, which continues to be one of the standout features of TurboTax.

- TurboTax’s New AI-Assisted Features: It can better detect potential errors or omissions on your tax forms before you submit your return.

- Improved Navigation and User Interface: TurboTax has always been known for its intuitive user interface, but with each version, the design gets even more user-friendly.

- More Free Features for Simple Filers: In addition to the basic federal and state filing, the free version now includes more comprehensive support for:

- Child Tax Credit and other common credits

- Student Loan Interest Deduction

- Earned Income Tax Credit (EITC) eligibility

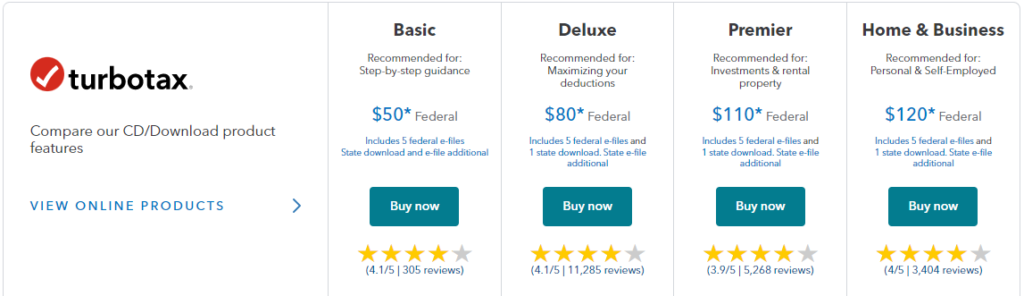

TurboTax Pricing 2024

It offers several different versions, each designed for different levels of tax complexity:

- TurboTax Free Edition: For simple returns (e.g., W-2 income, standard deduction).

- TurboTax Deluxe: For those who want to maximize deductions and credits (e.g., homeownership, charitable donations).

- TurboTax Premier: Ideal for investment income and rental property owners.

- TurboTax Self-Employed: For freelancers, contractors, and small business owners.

- TurboTax Live: Includes real-time support from tax experts for personalized guidance.

How to use Turbotax 2024?

Understand the steps of using TurboTax 2024 to file your federal and state taxes:

- Choose the right version of TurboTax that best suits your tax situation.

- Visit the TurboTax website or download the TurboTax mobile app.

- Select the Create an account option enter your email address, create a password, and select a security question to protect your account.

- Select Filing Status as Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er).

- Once you’ve entered all the necessary information, review the details and complete the account creation process.