IRS Direct Pay is a free service offered by the Internal Revenue Service that allows taxpayers to make payments for their federal taxes directly from their personal bank accounts. This service eliminates the need for credit cards or third-party services, providing a hassle-free way to settle tax obligations.

Whether you’re making a one-time payment for your tax bill, estimated taxes, or paying off an existing balance, IRS Direct Pay is a quick and secure option.

Inclusive Features to Pay Taxes

Whether you’re paying taxes owed, estimated taxes, or applying a payment to an existing balance, this service simplifies the process.

- No Fees: There are no processing fees or hidden charges for using IRS Direct Pay.

- Direct Bank Account Payments: Payments are made directly from your checking or savings account.

- Secure and Confidential: The system is encrypted and designed to protect your personal financial information.

- Available 24/7: You can use IRS Direct Pay anytime, and payments are processed quickly.

By eliminating third-party fees and offering a user-friendly experience, it’s a go-to choice for many taxpayers. Be sure to follow the steps carefully, review your information, and keep a record of your payment confirmation.

Use the IRS Direct Pay

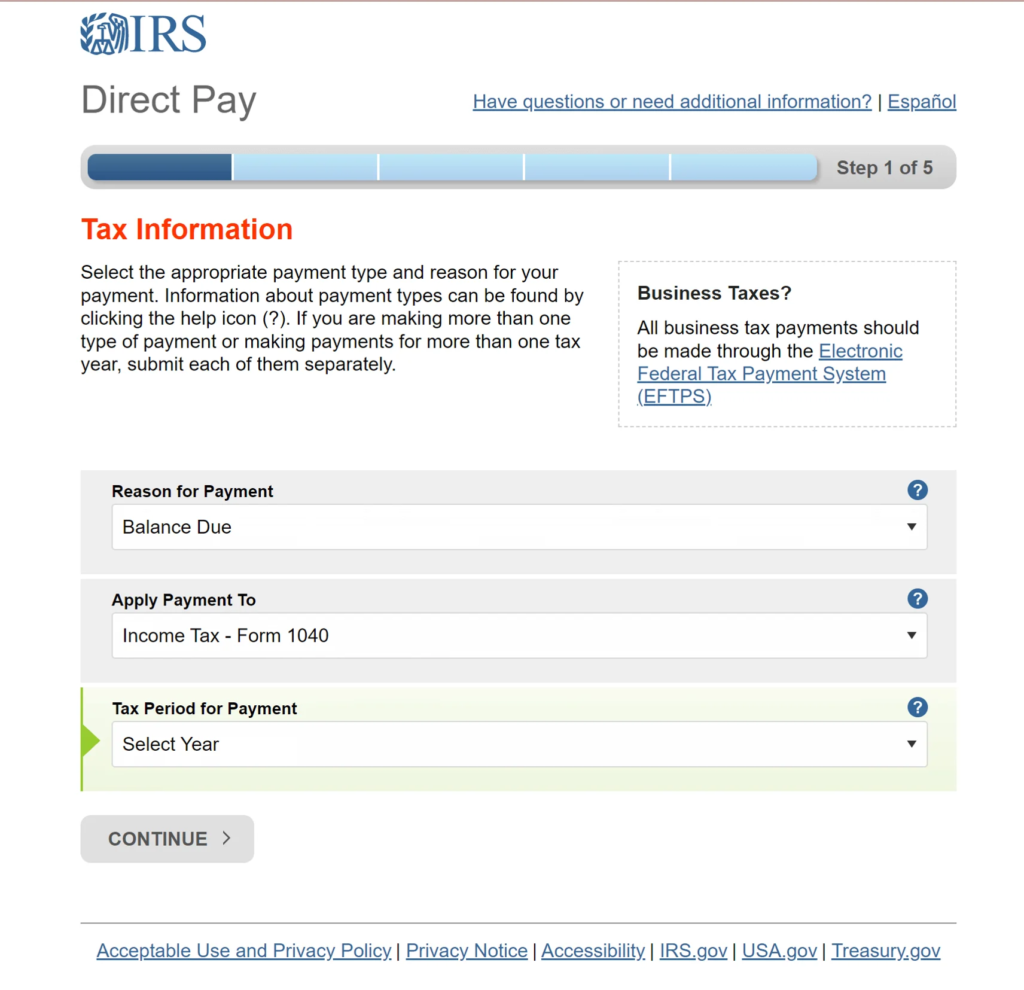

Using IRS Direct Pay is straightforward, so follow the step-by-step guide on how to make your payment and pay the taxes online:

- Visit the IRS Direct Pay website: Go to the official IRS website at IRS Direct Pay to get started.

- Choose the type of payment you’re making, such as individual income tax, estimated tax, or a balance due for a previous year.

- Provide personal details like your Social Security number (SSN), filing status, and the tax year for which you’re making the payment.

- Input the details of the bank account (checking or savings) from which the payment will be made. The IRS will automatically withdraw the payment on the date you choose.

- Review all the details to ensure everything is accurate. Once confirmed, submit your payment.

- Receive a confirmation number for your transaction, which you should save for your records. This provides proof that the payment was made.

IRS Direct Pay is a fast, free, and secure way to pay your federal taxes directly from your bank account. If any issues arise, IRS support is available to assist you.

Type of Payments with IRS Direct Pay

You can use Direct Pay to pay any taxes you owe from filing your federal income tax return, including penalties and interest if applicable.

- Self-employed individuals or those who need to make estimated quarterly tax payments can use Direct Pay to submit their payments.

- If you’ve set up an installment agreement with the IRS to pay off a tax debt over time, you can make your regular payments through IRS Direct Pay.

- If you’re required to pay penalties or fees for late payments or other tax issues, you can pay these charges through Direct Pay.

You can still mail a check or money order to the IRS. However, this method takes longer, and there’s a risk of your payment getting lost or delayed in the mail.

Benefits of Using IRS Direct Pay

There are several advantages to using IRS Direct Pay over other payment methods:

- There are no fees for payments. Unlike other methods, such as credit card payments, which often involve processing fees, IRS Direct Pay is entirely free.

- Make payments 24/7 from the comfort of your home, office, or anywhere with internet access. There’s no need to visit a bank or send a check through the mail.

- Use the encryption technology to ensure that your financial and personal information remains secure. This minimizes the risk of fraud or identity theft.

- Payments are processed quickly, and the funds are typically withdrawn from your account within one or two business days. You’ll receive immediate confirmation of your transaction.

You can contact the IRS at their customer service line for assistance with your payment, including any payment processing issues or questions about payment status.

Common Issues and Troubleshooting

While IRS Direct Pay is a reliable service, some issues may arise. Here’s how to handle them:

- Payment Not Going Through: Ensure that your bank account details are entered correctly. If you’re using a checking account, check to make sure there are sufficient funds.

- Payment Not Processed on Time: IRS Direct Pay allows you to select the date of your payment. Ensure that you choose a valid payment date and verify that the payment is processed.

- Technical Issues: If you’re having trouble accessing the IRS Direct Pay website or making a payment, try clearing your browser cache or using a different browser.

- Payment confirmation issues: If you don’t receive a confirmation number after completing a payment, contact the IRS to verify if the payment was successfully processed.

If you’re unsure about your payment or tax situation, you may want to consult with a tax professional who can guide you through the process and ensure you’re paying the correct amount.