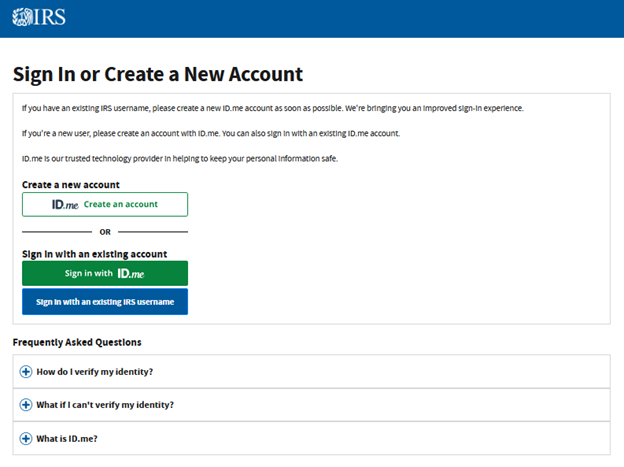

The irs.gov/account provides a secure and convenient way for taxpayers to access their personal tax information through the Account. This tool, available at irs.gov/account, empowers individuals to manage their tax records, make payments, and track refunds from the comfort of their homes.

Features of irs.gov/Account

The IRS Account is a centralized platform where taxpayers can view and manage their tax-related information.

- Tax Records Access: View your adjusted gross income (AGI), tax return transcripts, and any balance owed.

- Payment Management:

- Check outstanding tax balances.

- Make secure payments directly to the IRS.

- Set up payment plans for outstanding debts.

- Refund Tracking: Monitor the status of your federal tax refund.

- Notices and Alerts: Access and respond to IRS notices securely.

- Child Tax Credit Information: Review advance payment amounts and eligibility.

It provides real-time access to your tax records, payment history, refund status, and other critical details.

Manage IRS Online Account

If you experience issues accessing your account or require specialized assistance, visit the IRS Help Page or contact their support services.

- Regular Checks: Log in periodically to monitor your account and stay ahead of any potential discrepancies.

- Tax Season Prep: Download and review your tax records to streamline the filing process.

- Respond to Notices: Use the platform to quickly address IRS notifications and avoid penalties.

- Stay Organized: Keep track of past payments, refunds, and balances in one place.

The IRS Online Account is a powerful tool for managing your tax responsibilities efficiently and securely.

Why do users need to use an IRS account?

By visiting irs.gov/account, taxpayers can take control of their financial records, make informed decisions, and ensure compliance with tax obligations.

- Access your tax records 24/7 without the need to contact the IRS directly.

- Stay informed about your tax obligations and payments in real time.

- Resolve issues quickly, such as updating personal information or making payments.

- The online platform uses encryption and verification protocols to safeguard your data.

Whether you’re tracking a refund, managing payments, or preparing for the next filing season, this platform simplifies your interaction with the IRS and helps you stay on top of your tax life.