Paying your taxes is an essential responsibility, and the IRS offers several convenient methods to make the process easier. Whether you owe taxes or need to schedule a payment, irs.gov/payments provides multiple options. Let’s explore the payment methods available and how to use them.

Pay Directly from Your Bank Account – irs.gov/payments

The IRS Direct Pay service allows taxpayers to securely pay their tax bill directly from a checking or savings account. Here’s how it works:

- No registration is required.

- Available for individual and business tax payments.

- Payments can be scheduled in advance or made on the same day.

- Visit Direct Pay to get started.

Pay your taxes by paying with a debit or credit card

If you prefer to use a debit or credit card, the IRS accepts payments through approved third-party providers. Keep in mind:

- Service fees apply (based on the provider).

- Payments are secure and processed quickly.

- You can choose from a variety of providers.

- For a list of authorized providers, visit the IRS credit and debit card payment page.

Payment Plans: Monthly Installments for Tax Debt

If you can’t pay your tax bill in full, the IRS offers payment plans to help you manage your debt over time:

- Short-term payment plan: If you can pay within 180 days.

- Long-term payment plan: For those needing more than 180 days.

- To learn more or apply, go to the IRS payment plans page.

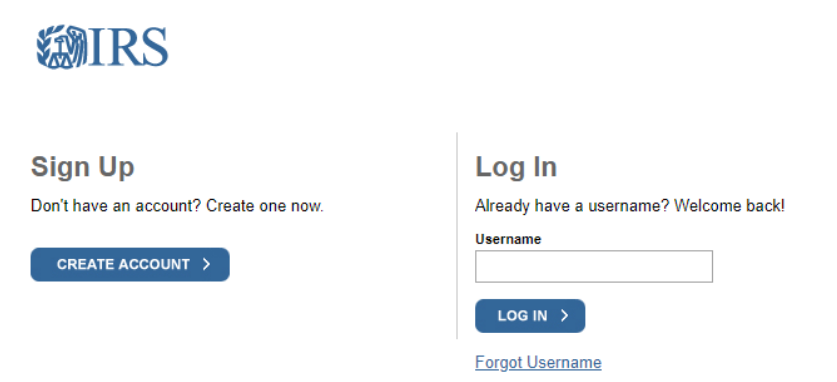

Electronic Federal Tax Payment System (EFTPS)

The Electronic Federal Tax Payment System (EFTPS) is a free service for individuals, businesses, and tax professionals:

- Make payments via the website or phone.

- Schedule payments in advance.

- Accessible 24/7.

- Learn more at the EFTPS website.

IRS Mobile App: Payments on the Go

For convenience, the IRS has a mobile app called IRS2Go:

- Make payments directly through the app.

- Track your payment history.

- Set up notifications for payment deadlines.

- Download the IRS2Go app from your app store.

Mailing a Check or Money Order

If you prefer traditional payment methods, you can mail a check or money order. Be sure to:

- Make it payable to “U.S. Treasury.”

- Include your name, address, phone number, and tax year on the check.

- Use the correct mailing address, depending on your state.

- Check the IRS payment mailing address for your location.

What Happens If You Can’t Pay Your Taxes?

If you’re facing financial hardship and unable to pay, the IRS offers options such as:

- Offer in Compromise (OIC): Settle your tax debt for less than the full amount owed.

- Temporary Delay: In some cases, the IRS may temporarily delay collection efforts.

- Explore these options on the IRS Help for Taxpayers page.

By understanding the payment options available on irs.gov/payments tax refund, you can choose the method that best suits your financial situation. Always ensure timely payments to avoid penalties and interest charges.