IRS tax forms are official documents used to report income, deductions, credits, and other tax-related information to the Internal Revenue Service (IRS). They serve as the foundation for calculating your tax liability or refund.

Categories Forms

- Individual Taxpayer Forms: These forms are used by individuals to file their annual income tax returns,

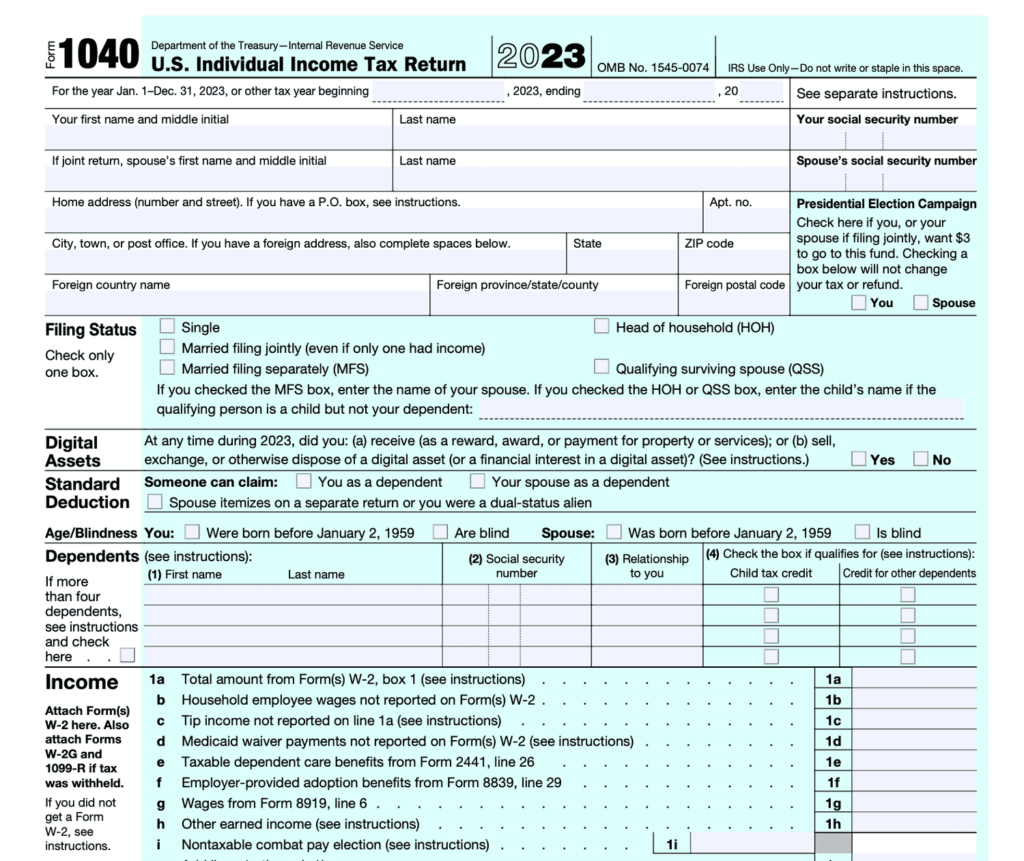

- Form 1040: The standard tax form for reporting income, deductions, and credits.

- Form 1040-SR: A simplified version of Form 1040 for seniors (65+), featuring larger text and a more user-friendly design.

- Form 1040-NR: For nonresident aliens filing a U.S. tax return.

- Investment and Property Tax Forms: Taxpayers with investments or property-related income use these forms,

- Schedule D (Form 1040): Reports capital gains and losses.

- Form 1099-DIV: Reports dividends and distributions.

- Form 1098: Reports mortgage interest paid.

- Employment Tax Forms: Employers use these forms to report wages, payroll taxes, and employee withholdings,

- Form W-2: Reports wages paid to employees and taxes withheld.

- Form 1099-NEC: Reports nonemployee compensation.

- Form 941: For reporting quarterly payroll taxes.

How to Access IRS Tax Forms?

Understanding IRS tax forms is key to a stress-free tax filing experience, and follow the simple instructions to access the IRS tax forms:

- Download Online: Visit the IRS Forms and Instructions page to download and print forms.

- Request by Mail: You can request paper forms to be mailed to you by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

- Local IRS Offices: Pick up forms at your nearest IRS Taxpayer Assistance Center.

- Tax Software and Professionals: Most tax software and professionals automatically include the necessary forms for your filing needs.

Whether you’re an individual filer, a business owner, or someone navigating investments, knowing which forms to use and how to access them simplifies the process.

How to handle Tax Forms on the IRS portal?

To handle Tax Forms on the IRS portal, follow the instructions and attach related documents for audit purposes:

- Know Your Filing Status: Your marital status, dependents, and financial situation determine the forms you need.

- Double-Check Form Numbers: Many forms have similar names and numbers (e.g., Form 1099-MISC vs. Form 1099-NEC). Use the correct one to avoid errors.

- Read Instructions: Each form has detailed instructions to help you fill it out correctly.

- File Electronically: E-filing reduces errors and speeds up processing compared to paper filing.

- Keep Copies: Save copies of all completed forms and related documents for at least three years for audit purposes.