QuickBooks Payroll is an online payroll service provided by Intuit, the company behind QuickBooks accounting software. It helps small business owners manage their payroll tasks, including paying employees, calculating taxes, filing tax forms, and more.

It is designed to integrate seamlessly with QuickBooks accounting software, which makes it a great choice for businesses already using QuickBooks for their accounting needs.

Why Choose QuickBooks Payroll?

There are several reasons why small business owners choose Payroll over other payroll services. Some of the main advantages include:

- Time-Saving Automation: Automates many aspects of payroll management, such as calculating employee wages, tax deductions, and filing tax forms.

- Accuracy: Payroll calculations can be complex, and mistakes can lead to penalties. It eliminates many of these errors by automatically calculating federal and local tax rates.

- Tax Filing: This helps you stay compliant by filing your payroll taxes on time. It can automatically file federal, state, and local payroll tax forms, which helps you avoid fines for late filings.

- Flexibility: Whether you have salaried, hourly, or freelance employees, QuickBooks Payroll can handle different types of payroll.

- You can easily adjust payment schedules, bonuses, commissions, and deductions, offering flexibility to suit your business’s needs.

With features like automated tax calculations, secure payments, and seamless integration with QuickBooks accounting software, it’s a great tool for business owners looking to save time.

Types of Payroll Plans

QuickBooks Payroll offers different plans to accommodate businesses of various sizes and needs. Here are the main payroll plans available:

- Core Payroll: This is the most basic plan that offers essential payroll services such as automatic payroll calculations, direct deposit and automated tax calculations, and email reminders for payroll tax payments.

- Premium Payroll: In addition to the Core Payroll features, the Premium plan includes same-day direct deposit, full-service payroll tax filing (including filing of tax forms and payment), workers’ compensation integration, HR support, and tools.

- Elite Payroll: The Elite plan includes everything in the Premium plan plus personal payroll expert support, advanced reporting tools, enhanced tax penalty protection, and priority customer support.

Each plan is designed to meet the needs of different businesses, from small startups to larger enterprises. QuickBooks Payroll allows businesses to choose a plan that aligns with their payroll needs and budget.

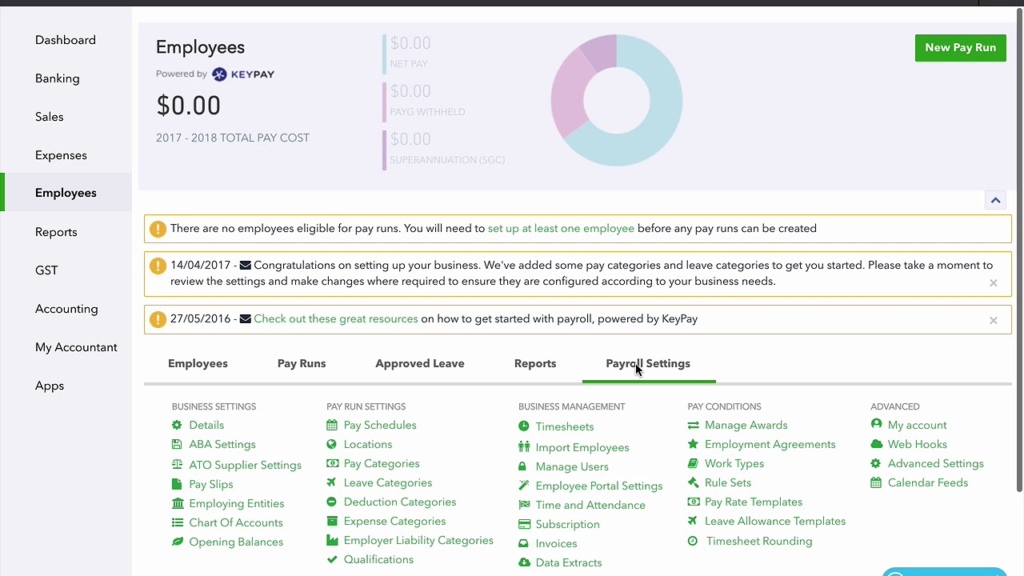

How to use Quickbooks Payroll?

Getting started with QuickBooks Payroll is simple. Here’s a step-by-step guide:

- Choose Your Plan: Visit the QuickBooks website and choose the payroll plan that best suits your business. You can select from Core, Premium, or Elite payroll plans based on your needs.

- Set Up Your Company: Enter your business information, including your business name, address, and employer identification number (EIN).

- You’ll also need to set up your employee records by adding details like their names, job titles, pay rates, and tax information.

- Sync with QuickBooks: If you’re already using QuickBooks accounting software, you can easily integrate QuickBooks Payroll with your existing QuickBooks account.

- Run Payroll: Once everything is set up, you can begin processing payroll. Simply enter your employees’ hours (or salary details), review the payroll summary, and hit “Run Payroll.”

- File Taxes and Make Payments: QuickBooks Payroll will automatically calculate, file, and pay your federal and state payroll taxes, ensuring compliance and saving you time.

By selecting the right plan and utilizing QuickBooks Payroll’s various features, you can ensure that your payroll processes are smooth, compliant, and efficient.

Benefits of QuickBooks

It is tailored to help small businesses streamline their payroll process while staying compliant with tax laws. Some key benefits include:

- Tax Compliance: Stay updated with the latest tax laws, ensuring that your business remains compliant with federal, state, and local payroll tax requirements.

- Secure Payments: With the software, you can pay your employees using direct deposit, which is both secure and convenient. Employees receive their paychecks on time, and you don’t need to worry about mailing checks.

- Employee Self-Service: It includes an employee portal where your employees can access their pay stubs, tax forms (such as W-2s), and other payroll-related information. This reduces the administrative workload for business owners and helps employees.

- Affordable Pricing: Offers affordable pricing options, especially for businesses already using QuickBooks accounting software. The cost of payroll services can vary based on the plan you select, but it is generally more affordable compared to other payroll.

- Scalability: Easily upgrade your plan to add more features or accommodate a larger workforce, making it a great long-term solution for businesses of all sizes.

QuickBooks Payroll is a reliable and user-friendly option that can scale with your business needs.

Support and Resources

QuickBooks offers various support options for users of QuickBooks Payroll. These include:

- Online Help Center: The QuickBooks Online Help Center provides step-by-step guides, FAQs, and troubleshooting tips for QuickBooks Payroll users.

- Customer Support: QuickBooks Payroll offers customer support via phone, live chat, or email. Premium and Elite plan users can access dedicated support with faster response times.

- Webinars and Tutorials: QuickBooks offers free webinars and video tutorials to help users get the most out of their payroll system.

- Community Forum: The QuickBooks Community Forum allows users to ask questions, share experiences, and get advice from other QuickBooks Payroll users.