Vanguard Retirement Income is a set of strategies and investment products designed to help retirees convert their accumulated retirement savings into a steady stream of income. Vanguard offers a range of products and services that provide retirees with the means to ensure their savings last in retirement.

These offerings are focused on helping retirees navigate the complex process of drawing down assets in a tax-efficient manner while maintaining an appropriate level of risk.

Components of Vanguard Retirement Income

Vanguard’s approach to retirement income emphasizes low-cost, diversified investments and well-structured withdrawal plans to provide retirees with the stability they need.

- Income-focused mutual funds and ETFs: Vanguard offers a variety of investment funds designed for retirees who want to generate consistent income from dividends, interest, or capital gains.

- Withdrawal strategies: Vanguard guides on how much and when to withdraw from retirement accounts to help maintain a steady income while minimizing the risk of outliving your savings.

- Annuities: Vanguard also offers annuity options through third-party providers, such as guaranteed income annuities, which provide retirees with a predictable income stream for life.

These investments provide regular income payouts and are designed with a lower risk profile to match the needs of retirees who are no longer contributing to their retirement savings.

Exclusive Vanguard Retirement Features

Vanguard’s retirement income solutions are designed to provide retirees with a comprehensive set of tools, investment options, and strategies to manage their savings for reliable income in retirement.

- Income-Focused Investment: It offers a broad array of income-focused investment products, allowing retirees to choose a mix of funds that best suit their income needs and risk tolerance.

- Systematic Withdrawal Plans: These withdrawals can be scheduled monthly, quarterly, or annually, providing a predictable income stream without the need for active management.

- Flexibility: Retirees can choose how much and when to withdraw, allowing for customization based on changing income needs or market conditions.

- Automated Withdrawals: Vanguard provides automated systems to set up withdrawals, so retirees don’t have to worry about manually managing their distributions.

- Annuity for Guaranteed Income: Vanguard partners with third-party providers to offer annuity products. These annuities can help reduce the risk of outliving your savings by providing a lifelong income stream.

- Immediate Annuities: These annuities begin payments immediately after purchase, providing retirees with a fixed income for life or a set period.

- Deferred Income Annuities: This option allows retirees to defer income payments until a later date, often many years into retirement, helping with long-term income planning.

- Comprehensive Retirement Planning Resources: Vanguard provides a wealth of tools and resources to help retirees plan for their income needs, manage their savings, and optimize their retirement strategy.

Vanguard’s retirement income solutions combine low-cost investment products, tax-efficient strategies, and flexible withdrawal options to help retirees generate sustainable income throughout retirement.

Why to choose Vanguard for retirement income?

Vanguard stands out in the retirement income space due to its commitment to low-cost, diversified investment options and its long-standing reputation for helping investors meet their financial goals. Some of the reasons to consider Vanguard for your retirement income planning include:

- Low Costs: Vanguard’s index funds and ETFs typically have lower expense ratios compared to other investment managers. This means more of your money stays in your portfolio, helping it grow over time.

- Expertise: Vanguard has decades of experience in retirement planning and offers a range of tools, resources, and personal advisors to help you plan effectively for retirement.

- Flexibility: Whether you’re looking for growth, income, or a combination of both, Vanguard’s wide array of investment products gives you the flexibility to customize your retirement income strategy.

By diversifying your investments, selecting the right income-generating products, and employing a strategic withdrawal plan, you can build a sustainable retirement income strategy that aligns with your long-term financial goals.

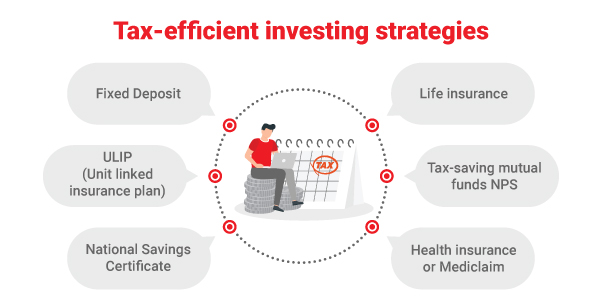

Tax Strategies for Retirement Income

Managing taxes in retirement is crucial for maximizing the income you can generate from your savings. Vanguard provides strategies and tools to help retirees minimize their tax liabilities, preserving more of their income for their daily needs.

- Tax-Deferred Accounts: Withdrawals from tax-deferred accounts like traditional IRAs or 401(k)s are taxed as ordinary income. Vanguard can help you develop a withdrawal strategy that minimizes the tax impact by considering factors such as your tax bracket.

- Roth IRA Withdrawals: Since Roth IRAs are funded with after-tax money, qualified withdrawals in retirement are tax-free. Vanguard helps retirees incorporate Roth IRAs into their retirement income strategy, balancing tax-deferred and tax-free income sources.

- Tax-Loss Harvesting: Vanguard offers tax-loss harvesting services through its managed account platform, which helps offset taxable gains by selling investments that have declined in value. This strategy can reduce your overall tax liability, increasing the after-tax income.

Whether you’re looking for income-focused funds, guaranteed annuities, or personalized retirement planning advice, Vanguard’s features are designed to support your financial security in retirement.