Vanguard Target Date Funds are a type of mutual fund that automatically adjusts its portfolio mix of stocks, bonds, and other assets based on a target retirement date. As the target date approaches, the fund’s allocation becomes more conservative to reduce risk as you near retirement age.

- Target Date: The year in the fund’s name (e.g., Vanguard Target Retirement 2050 Fund) is the target year when the investor plans to retire.

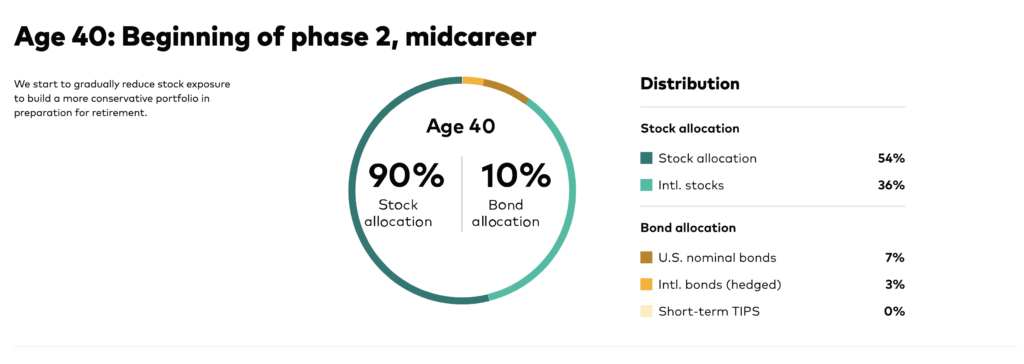

- Dynamic Asset Allocation: Vanguard’s TDFs are designed to gradually shift from a higher allocation of stocks (to achieve growth) to a higher allocation of bonds (to preserve capital) as the target date approaches.

How do Vanguard Target Date Funds work?

Vanguard Target Date Funds are managed with a glide path, which is the fund’s predetermined allocation strategy. The glide path defines how the fund’s asset allocation will change over time as it gets closer to the target retirement year.

- Growth Phase (Early Years): In the early years, the fund invests heavily in equities (stocks) to capture higher returns from the stock market, which historically offers greater growth potential over the long term.

- Transition Phase (Mid-Life of Fund): As the target date nears, the fund starts shifting its allocation gradually from equities to fixed-income investments, like bonds, which are considered safer and more stable.

- Conservative Phase (Approaching Retirement): In the years leading up to the target date, the fund holds a higher percentage of bonds, cash equivalents, and other safer assets, reducing the overall risk and volatility of the portfolio.

Vanguard manages this glide path automatically, so you don’t have to worry about making manual adjustments to your asset allocation.

Exclusive Features of Vanguard Target Funds

Vanguard Target Date Funds offer several advantages, making them an appealing choice for investors, especially those who prefer a hands-off approach to retirement planning. Here are some of the primary benefits:

- It automatically adjusts your portfolio as you get closer to retirement, so you don’t have to worry about rebalancing your investments or changing your asset allocation.

- Vanguard’s TDFs invest in a broad range of asset classes, including domestic and international stocks, bonds, and sometimes other assets like real estate or commodities, giving you a diversified portfolio without the need to pick individual investments.

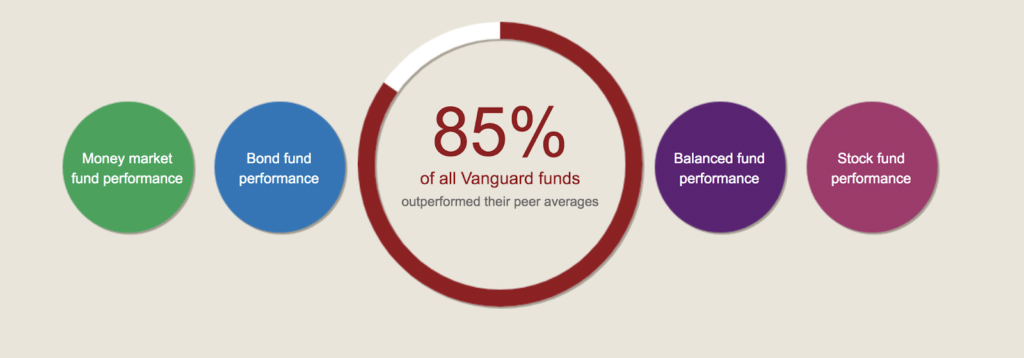

- Vanguard is known for its low expense ratios, meaning you pay less in fees compared to other mutual funds. Lower fees can help you keep more of your investment returns over time.

- Vanguard’s TDFs are managed by experienced portfolio managers who make decisions based on thorough research and market analysis, saving you time and effort.

- The gradual shift from riskier stocks to more conservative bonds helps protect your investment as you near retirement, ensuring that your savings are less exposed to market volatility as you approach your retirement date.

For investors who want a simple, long-term solution to retirement investing, Vanguard Target Date Funds can be an excellent option.

Vanguard Fund Costs and Fees

Vanguard is known for keeping expense ratios low, which is particularly important for long-term investors, as high fees can significantly erode returns over time.

- Expense Ratios: Vanguard’s Target Date Funds typically have lower expense ratios compared to other funds in the market. Vanguard’s TDFs generally charge an expense ratio ranging from 0.12% to 0.15%, depending on the fund and the share class. These fees are well below the industry average, which can often be 1% or higher for similar funds.

- Impact of Fees on Returns: Over time, even small differences in fees can add up. For example, a 1% fee difference might seem insignificant in the short term, but it can mean a substantial difference in retirement savings over 30 years. Vanguard’s lower fees allow you to keep more of your investment returns.

- No Sales Loads: Vanguard’s TDFs do not charge any sales loads or commissions, so all your investment goes toward your retirement savings, maximizing your returns.

When choosing a Target Date Fund, it’s important to understand the fees associated with each option, and Vanguard’s low-cost offerings make it an attractive choice for cost-conscious investors.

Important Considerations

While Vanguard Target Date Funds offer a simplified, hands-off approach to retirement investing, there are still some risks and considerations to keep in mind:

- Target Date Funds are subject to market risk. Even though the funds become more conservative as you approach retirement, they still hold a portion of stocks, which are subject to market volatility.

- Your retirement date may change due to unforeseen circumstances, which could require you to reassess your investment strategy. Vanguard’s TDFs are based on a specific target date, so if your retirement plans shift, you might need to consider a different fund or investment strategy.

- While Target Date Funds provide a diversified, automatic solution, they may not be the best fit for every investor. If you have a more complex financial situation or prefer to make specific investment choices, you might need to manage your retirement portfolio more actively.

It’s important to regularly review your retirement strategy and ensure that your Vanguard Target Date Fund remains aligned with your financial goals.

Retirement Income Strategies

Vanguard Target Date Funds can play a critical role in this transition. Here’s how they can be part of your broader retirement income strategy:

- Gradually allocate more assets to bonds, which provide more stable income and lower volatility than stocks. This can be beneficial when you are in retirement and rely on your portfolio for regular income.

- Set up systematic withdrawals from your Vanguard Target Date Fund to generate income. You can decide whether you want monthly, quarterly, or annual withdrawals based on your needs.

- Vanguard’s TDFs provide growth in the years leading up to retirement, it’s important to supplement your retirement income with other strategies, such as Social Security, pensions, or annuities, to create a more secure income plan.

Vanguard Target Date Funds are designed to reduce risk as retirement nears, but they are just one piece of your broader retirement income strategy.