The https //www.irs.gov account login allows you to perform several essential tasks related to your taxes, including reviewing your account balance, making payments, viewing your tax records, and tracking your refund status.

By logging into your IRS account, you can access real-time information and manage your tax matters more efficiently, saving you time and effort compared to traditional methods.

Log into your IRS Account

Logging into your IRS account is a simple process, but it requires several steps to ensure your security. Here’s how you can do it:

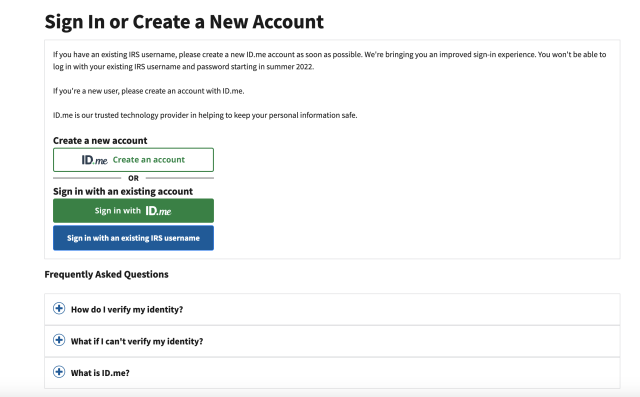

- Visit the IRS Website: Go to the official IRS website at IRS.gov/account and the IRS online account login page, where you can enter your information securely.

- Verify Your Identity: The IRS requires you to verify your identity. This step is necessary to protect your personal information.

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Your tax filing status (e.g., single, married filing jointly).

- The exact amount of your last tax return refund or amount due.

- The IRS uses ID.me, a trusted identity verification service, to securely verify your identity. If you haven’t set up an ID.me account yet, you’ll need to create one by following the prompts on the IRS login page.

- Once your identity is verified, you will be able to access your IRS account. You can now view your balance, payment history, tax transcripts, refund status, and other important information.

Use of IRS Login Account

While logging into your IRS account is a straightforward process, sometimes problems can arise. Once you’ve logged in, you can take advantage of several helpful features:

- Review Your Account Balance: View the balance of your tax account, including any amounts owed or any refunds issued. Review and manage the overall IRS tax status in your IRS login account.

- Check Your Refund Status: The portal will tell you if your refund has been approved when it was sent or if it’s still processing. This is an easy way to keep track; you’ll receive your refund.

- Request Tax Transcripts: Provides several types of transcripts, such as the Tax Return Transcript and Account Transcript, which summarize your tax filings and account information.

- Make Payments or Set Up Installments: Provides several options, including electronic payments and bank transfers, and allows you to choose a payment plan that works for you.

- Manage notifications and correspondence: View any notices or letters from the IRS in your account, which helps you stay on top of important communications.

Benefits of Logging into IRS Account

There are several advantages to logging into your IRS account through IRS.gov:

- Access to Your Tax Information: You can review your past tax returns, check your balance, and view other important tax records.

- View Payment History: You can see all the payments you’ve made to the IRS, helping you track how much you’ve paid and if there’s a remaining balance.

- Request Tax Transcripts: You can request and download various IRS transcripts, such as your Tax Return Transcript, Account Transcript, and Record of Account, to verify your income, review deductions, and more.

Whether you’re checking the status of your refund, reviewing your payment history, or requesting tax transcripts, the IRS account portal provides a secure and convenient way to keep tracking.