IRS.gov/account is a secure online service provided by the Internal Revenue Service (IRS) that allows taxpayers to view and manage their tax accounts online. It provides an easy way to access information about your tax history, payments, and balances.

The IRS has designed this service to be user-friendly, ensuring that taxpayers can quickly access important information without having to call the IRS or wait for paperwork to arrive in the mail.

Key Features of IRS.gov/account

The IRS.gov/account tool is packed with features to help you manage your tax information. Here’s a breakdown of the key functions available:

- View Your Tax Account Balance: Access to see the current balance on your tax account, including any outstanding balances or amounts due.

- Review Payment History: View a detailed payment history, which includes payments made toward your balance, adjustments to your account, and scheduled payments (if applicable).

- Access Your Tax Records: This allows you to request and view transcripts of your tax returns. You can access the following types of tax records:

- Tax Return Transcript: A summary of your filed tax return for a specific year.

- Account Transcript: Run account activity, including payments, penalties, and adjustments.

- Record of Account Transcript: Provides both your tax return and account details.

- Track the Status of Your Refund: If you’ve filed your tax return and are expecting a refund, you can track its status through the IRS.gov/account tool.

- Manage Your Direct Deposit Information: Update your direct deposit information securely through your account. This makes it easier for the IRS to deposit refunds or process payments.

- Make Payments and Set Up Payment Plans: If you owe taxes and are unable to pay the full amount at once, you can set up a payment plan directly through the portal.

- Installment agreements

- Direct payments

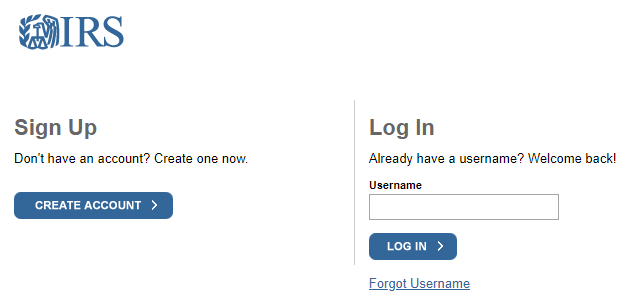

Access your IRS Account

Setting up a payment plan is especially helpful if you need flexibility in paying off your tax debt over time. Follow these steps to get started:

- Visit IRS.gov/account: Go to the official IRS website at IRS.gov/account to begin.

- Verify Your Identity: To access your account, you will need to verify your identity using two-factor authentication (2FA).

- Create a username and password: Make sure your password is secure to protect your sensitive information.

- Access Your Account: Once your identity is verified, you will be able to view your tax account. Access various features such as balance, payment history, transcripts, and important documents.

- You can take actions directly through your account, such as making payments, requesting transcripts, or setting up payment plans.

Benefits of Using IRS.gov/account

Using the IRS.gov/account tool offers many benefits for taxpayers. Here are a few key reasons why you should consider accessing your account online:

- Access your tax information anytime, anywhere. No more waiting in line on the phone with the IRS or waiting for letters in the mail.

- Your information is protected through the use of advanced security measures, giving you peace of mind when accessing sensitive tax data.

- You’ll receive up-to-date information on your account status, including refund status, payments, and any notices or updates from the IRS.

- Accessing your tax records online eliminates the need for paper copies of tax transcripts, notices, or forms. This reduces paperwork and helps you keep everything organized.

- You can make payments, request extensions, or set up payment plans without needing to mail in paperwork.

By providing access to tax records, payment histories, and other important information, this online service eliminates the need for paper-based communication and gives you the flexibility.