The Where’s My Refund? IRS tool is an online service provided by the Internal Revenue Service (IRS) that allows taxpayers to track the status of their federal income tax refund.

Tax season can be a stressful time of year, but getting a tax refund can bring some relief. After you file your tax return, so with “Where’s my refund?” to track the status of your refund.

How to use the “Where’s My Refund” IRS Tool?

This tool provides real-time information on the status of your refund, helping you stay updated on when to expect it. Here’s how to do it:

- Gather Your Information: Before you can check the status of your refund, you’ll need the following information:

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

- Your filing status (e.g., single, married filing jointly).

- The exact amount of your refund is listed on your tax return.

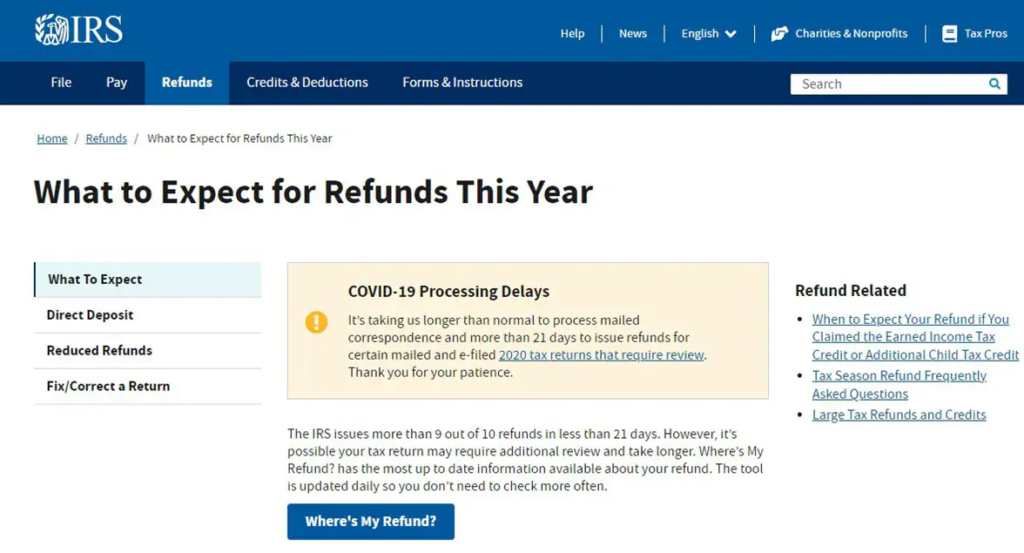

- Go to the IRS website: Visit the official IRS website at www.irs.gov and find the Where’s My Refund? tool under the “Refunds” section.

- Enter Your Information: Once you’re on the Where’s My Refund? page, you will be asked to input your SSN or ITIN, filing status, and refund amount.

- Click Submit after entering your details.

- Track Your Refund Status: The IRS has received your tax return, and the IRS has processed your return, and your refund is approved. At this point, they’ve sent the refund to your bank account.

- This status indicates that the IRS has issued your refund. If you’re getting a direct deposit, it will show up in your account soon.

The IRS advises taxpayers to wait at least 21 days after e-filing their tax return before inquiring about their refund. For paper returns, refunds can take longer due to manual processing.

How long will it take to get my refund?

The IRS states that most refunds are issued within 21 days of filing, especially if you filed electronically and opted for direct deposit. The exact time frame can be based on factors, including:

- E-filed returns are processed much faster than paper returns, which require manual processing and can take several weeks.

- If there are errors on your return (e.g., incorrect information, mismatched names, or missing forms), the IRS will need additional time to process your refund.

- If your return is flagged for an audit or additional review, your refund may take longer.

- If you choose direct deposit, your refund will likely arrive more quickly than if you requested a paper check, which can take longer to process and mail.

Double-check that the SSN, filing status, and refund amount are entered correctly. Even small discrepancies can prevent the tool from displaying accurate results.

Troubleshooting Ways if you won’t receive Refund

If it has been more than 21 days (for e-filed returns) or longer than 6 weeks (for paper returns), and your refund status is still showing as “Return Received” or “Being Processed”:

- Wait a Few More Days: Sometimes, processing can take a bit longer due to various reasons, especially if your return is under review.

- Contact the IRS: If you don’t receive your refund within the expected time frame, you can call the IRS directly at 1-800-829-1040 for assistance.

- Check for Errors: Ensure that all the information on your return is correct. If there are discrepancies or if you forgot to include necessary forms.

While most refunds are issued within 21 days of filing, delays can happen due to errors, additional reviews, or other reasons.