Sales tax is a consumption tax imposed on the sale of goods and certain services. In Wisconsin sales tax, is 5% at the state level. However, this rate can be higher depending on where you are located in the state, as counties and municipalities are allowed to levy additional local sales taxes.

The revenue generated from sales tax helps fund various public services like education, transportation, and healthcare.

Wisconsin Sales Tax Rates

For businesses, understanding how sales tax works is crucial for both compliance and financial planning.

- State Sales Tax Rate: The state sales tax rate in Wisconsin is 5%, which applies to most tangible goods sold in the state. In addition to the state rate, some cities and counties impose additional local sales taxes.

- Local Sales Taxes: The total sales tax rate in certain areas may range from 5.5% to 6.75%. For example, in Milwaukee County, the total sales tax rate is 5.6% because of an additional 0.6% county tax.

- Other Sales Tax Rates

- Food and Drink: Most food items purchased for home consumption are exempt from sales tax. However, prepared food (like restaurant meals) is taxable.

- Clothing: Clothing is not taxed in Wisconsin unless it is considered a luxury item or the purchase is considered a special case, such as clothing sold in combination.

While many everyday goods and services are subject to sales tax in Wisconsin, not everything is taxable.

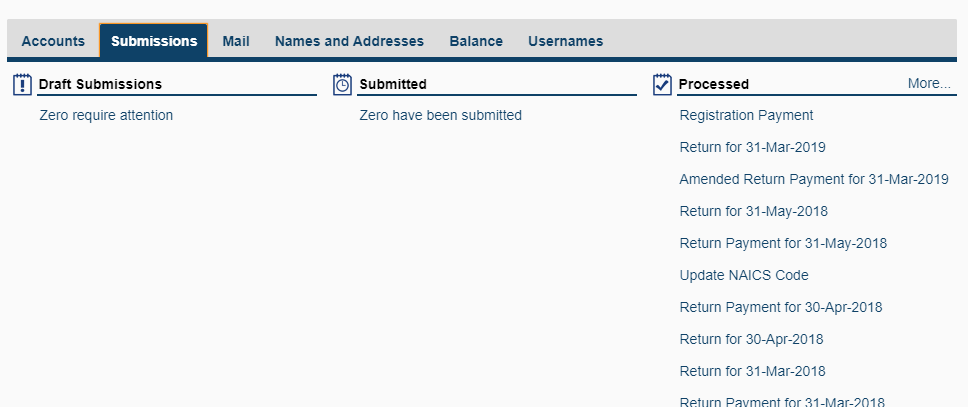

How to File Wisconsin Sales Tax?

If you’re a business owner in Wisconsin, you are required to collect and remit sales tax for taxable sales. Here’s a step-by-step guide to filing sales tax in Wisconsin:

- Register for a Sales Tax Permit: Register for a sales tax permit with the Wisconsin Department of Revenue (DOR). You can do this online via the Wisconsin Department of Revenue website.

- Collect Sales Tax: You must apply the correct sales tax rate based on your business location. For businesses operating in multiple locations across Wisconsin.

- File Sales Tax Returns: Sales tax returns in Wisconsin must be filed either monthly, quarterly, or annually, depending on your sales volume.

- Monthly: Businesses that collect more than $3,000 in sales tax per year are required to file every month.

- Quarterly: If your business collects between $200 and $3,000 in sales tax per year, you’ll need to file quarterly.

- Annually: Small businesses that collect less than $200 annually in sales tax are permitted to file yearly.

- Submit Your Payment: After filing your sales tax return, you’ll need to submit the payment to the Department of Revenue.

- Keep Records: These records should include invoices, receipts, and tax returns for at least four years in case you need to reference them or in the event of an audit.

Common Sales Tax Mistakes & Solutions

Filing and collecting sales tax can be complex, and mistakes can be costly.

- Not registering for a sales tax permit: Even small businesses must register with the Wisconsin Department of Revenue before collecting sales tax.

- Not charging sales tax on taxable items: Be sure that all taxable goods and services are charged sales tax.

- Filing late: Always file your sales tax return on time. Late filings can result in penalties.

- Failing to keep proper records: Maintain accurate sales records, tax returns, and proof of tax-exempt transactions.

By staying informed about Wisconsin sales tax laws and keeping accurate records, you can minimize errors and stay compliant with the state’s tax regulations.