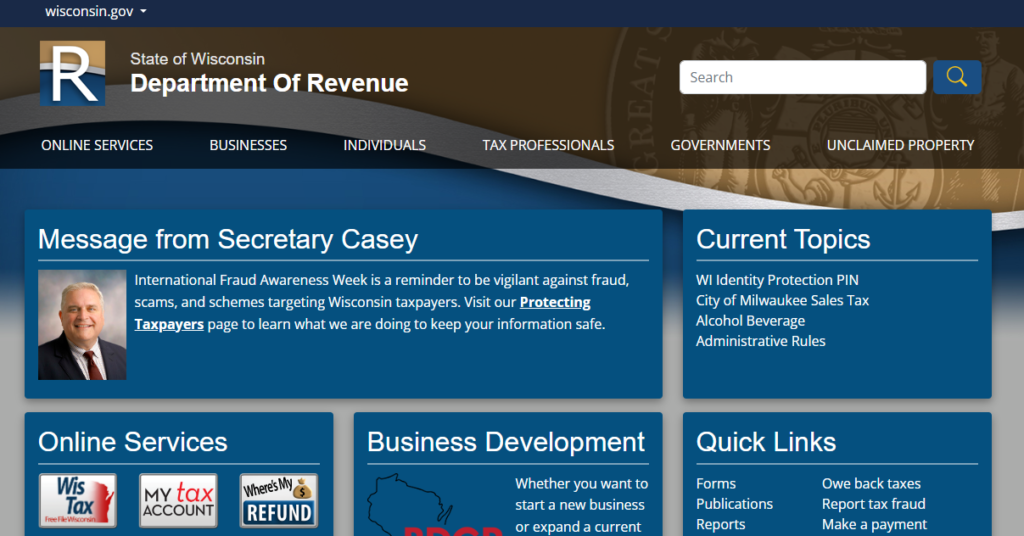

For residents and businesses, the Wisconsin Department of Revenue (DOR) offers a comprehensive and user-friendly platform on Wisconsin.gov Taxes to help with all aspects of state tax filing.

Property taxes in Wisconsin are levied by local governments (cities, counties, towns, and school districts), and the DOR helps to administer these taxes.

How to File Wisconsin Taxes – Wisconsin.gov

The Wisconsin Department of Revenue has made it easier for taxpayers to file their taxes through the official state portal on Wisconsin.gov.

- The official state tax portal can be accessed at www.wisconsin.gov. Look for the “Taxes” section under the Department of Revenue.

- To create an account, visit the My Tax Account portal on the Wisconsin DOR website. If you already have an account, simply log in using your username and password.

- Wisconsin offers free online filing for individuals through its e-file system. This is a great option if you’re filing a simple individual income tax return.

- Once you’ve logged in and selected your filing option, you’ll need to fill out the appropriate tax forms. For businesses, the forms you need will depend on your business structure.

- Before submitting your forms, be sure to review everything carefully. Errors in your filing could result in delays, penalties, or audits.

- If you owe taxes, you can make your payment directly through the Wisconsin.gov portal. The website allows for secure online payments.

What is Wisconsin Tax Filing Deadlines?

Be aware of important deadlines for filing and paying taxes in Wisconsin. For most individuals, the state income tax deadline is April 15th of each year. However, if you’re unable to file by this date, you can apply for an extension to file your return later.

If you’re filing for business taxes or sales taxes, the deadlines may vary based on your filing frequency (monthly, quarterly, or annually). Be sure to check the specific dates for your situation on the Wisconsin DOR website.

What if I need help filing my taxes?

If you’re unsure about how to file your taxes or need assistance with your return, the Wisconsin Department of Revenue offers a variety of resources:

- Customer Service: Wisconsin DOR provides support by phone, email, and even live chat for common tax questions.

- Taxpayer Assistance: If you need help understanding specific forms or guidelines, the website offers detailed instructions, FAQs, and guides for different types of taxpayers.

- Free Tax Filing Assistance: Wisconsin also partners with volunteer organizations to provide free tax preparation for qualifying individuals, particularly low-income taxpayers.

Filing taxes in Wisconsin has become much easier thanks to the state’s user-friendly online tools available through Wisconsin.gov.